Published: October 23, 2022

-Global News

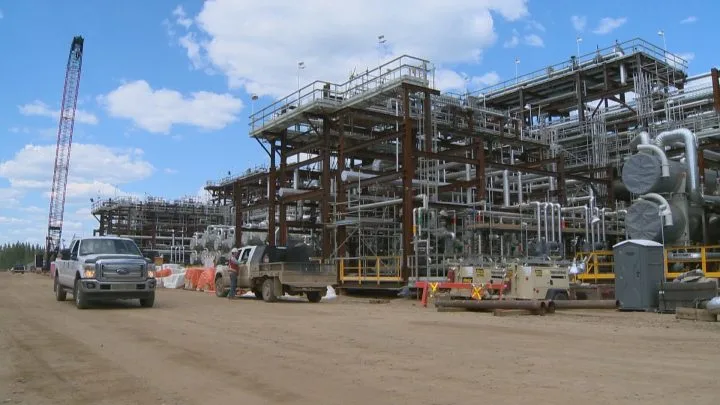

Since the start of the year, Alberta’s oil production has been booming.

“We’re producing about $12 billion a month of oil,” said Alberta Central’s chief economist Charles St-Arnaud.

“To give a comparison, in 2014, the maximum we reached was $7.7 billion so it’s a big increase.”

However, St-Arnaud said we are not feeling the same effects of this boom like we did in 2014.

“What’s happening is that a greater share of this revenue is actually leaving the province,” St-Arnaud explained.

“The issue there is that 75 per cent, on average, of those of those producers or the shareholders of those producers are foreigners — they’re not even Canadian. So it doesn’t even stay in Canada and even less in Alberta.”

He noted the other part to this is there’s a much smaller share of revenue being reinvested into the business.

“Over the past year, about seven per cent of revenues have been returned into investment. Back in 2014, it was 25 per cent, so there’s a lot of money that is no longer staying and creating jobs and spillovers to the rest of the economy,” St-Arnaud explained.

He said the nature of the industry has changed permanently and the changes are linked to the general outlook of the oil and gas sector.

“If we take the International Energy Agency, they expect oil demand to probably peak in early 2030s,” St-Arnaud said.

“It doesn’t necessarily make sense for big oil producers to create a new oil sands mine because you need to commit tens of billions of dollars upfront to produce for the next 30 to 40 years when you know demand is going to dwindle.”

Executive fellow with the School of Public Policy at the University of Calgary, Richard Masson also noted investment is lower in part because Alberta doesn’t have the pipelines allowing us to get to market.

“Until we have assured market access, it’s a huge impediment to people wanting to invest in new production,” Masson said.

“Lately what shareholders have said is right now give us back money, pay down debt, buy back shares, pay dividends and that’s what the companies are doing.”

Masson said while many might believe the end of the industry is in sight, he doesn’t believe that’s the case.

“I think the end is a long ways off still,” Masson said.

“There’s evidence of that in Europe right now — trying to struggle with the implications of the Russian invasion of Ukraine. I think it’s going to be a long time before we really get meaningful transition.

In the meantime, the industry here is working to improve its performance.”

In a statement, a spokesperson for the energy minister said the future of the energy sector is bright.

“Alberta is rapidly reducing emissions and expanding carbon capture and storage to embrace a low-carbon future. We have the innovation, technology and expertise Canada and the world need right now, and our energy sector is surging thanks to stronger than expected prices,” Alex Puddifant said.

“As we pursue innovation in emissions reduction technologies and integrate renewables and other lower-carbon sources into the mix, all reasonable forecasts show that demand for oil and gas will continue for decades to come, even in a net-zero world.”

The province is benefitting from high oil prices. A big portion of money is going to governments through higher royalties and taxes.