Reuters

Published: June 9, 2022

-Financial Post

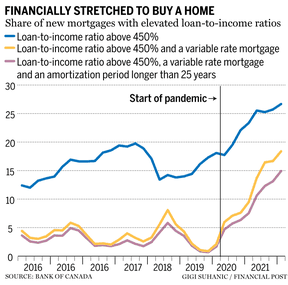

OTTAWA — Some Canadians who took out mortgages in 2020-21 could see their monthly payments jump by as much as 45 per cent in 2025-26, given rising rates, according to a Bank of Canada scenario released on Thursday.

“In this context, highly indebted households are especially vulnerable to a loss of income,” it said.

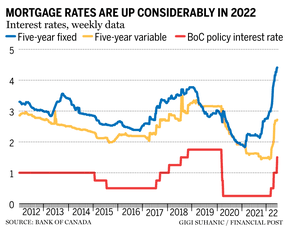

The bank increased rates by 50-basis-points in April and June and money markets are betting on another half point rise in July.

Canadians with a high loan-to-income ratio variable rate mortgages would see payments rise by 45 per cent in 2025-26 upon renewal. The overall increase in monthly payments for all types of mortgages originating in 2020-21 would be 30 per cent.

The scenario focused on mortgages with a five-year term taken out at banks in 2020-21, when rates were at record lows. It assumed variable- and fixed-rate mortgages would renew at median rates of 4.4 per cent and 4.5 per cent respectively in 2025-26.

“A larger share of households took out mortgages that were large relative to their income,” it added. The bank’s classification of a high loan-to-income ratio includes mortgages that had a loan-to-income ratio above 450 per cent at origination.

In the review, the bank said it was paying particular attention to the fact that a greater number of Canadian households were carrying high levels of debt. Those who entered the market in the last year or so would be more exposed in case of a significant price correction, it said.